Table of Contents

Introduction

Language used: R (Markov Chains package)

Task to solve: Analyze the Bad Payers situation.

Transitional matrix with this components:

Group A (good payers)

- 30% will stay in this category

- 30% will become a bad payer (Group B)

- The rest will pay all overdue

Group B (bad payers)

- 10% goes to the default stage

- 20% pays the overdue

- 40% will stay in Group B

- 30% will go to Group A

D (default): Default

P (pagado): Paid

Markov Chain

Transitional Matrix

The states D and P are absorbing states.

The states D and P are absorbing states.

Probability D P A 0.09 0.91 B 0.21 0.79

Additional Limits:

| Investment type | Investment out of all funds | |

|---|---|---|

| Consumer credit | Maximum 15% | |

| Housing loans & Gold deposits | Minimum 5% |

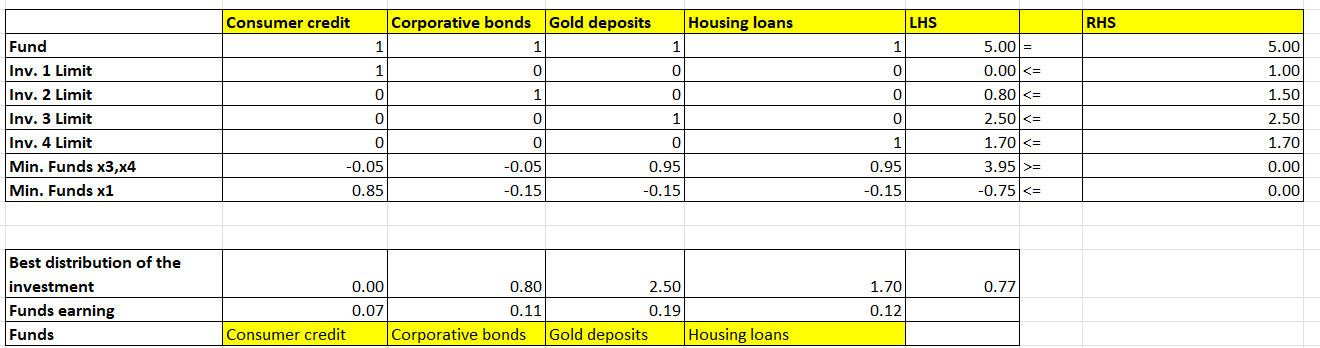

Mathematical Model

Decision Variables:

- Consumer credit

- Corporative bonds

- Gold deposits

- Housing loans

Function to maximize the earnings Z=0.07*x1+0.11*x2+0.19*x3+0.12*x4

Limits

- x1+x2+x3+x4=5

- x1<=1

- x2<=1.5

- x3<=2.5

- x4<=1.7

- x3+x4>=0.05(x1+x2+x3+x4)

- x1<=0.15(x1+x2+x3+x4)

Solution

Best distribution of the investment

Starting Fund to invest: $5.000.000,00

| Type of investment | Amount of investment ($) | Percentage of the total earnings |

|---|---|---|

| Consumer credit: | 0 | 0,00% |

| Corporative bonds | 800.000,00 | 16,00% |

| Gold deposits | 2.500.000,00 | 50,00% |

| Housing loans | 1.700.000,00 | 34,00% |

| Earning to be achieved (per year) as per calculations |

|---|

| $ 767.000,00 - 15,34% of the starting investment |